If Healthcare Costs Continue to Rise Insurance Companies Fear That

Consumers will be driven to competitors who can offer lower prices. 6 Reasons Health Insurance Costs Continue To Rise.

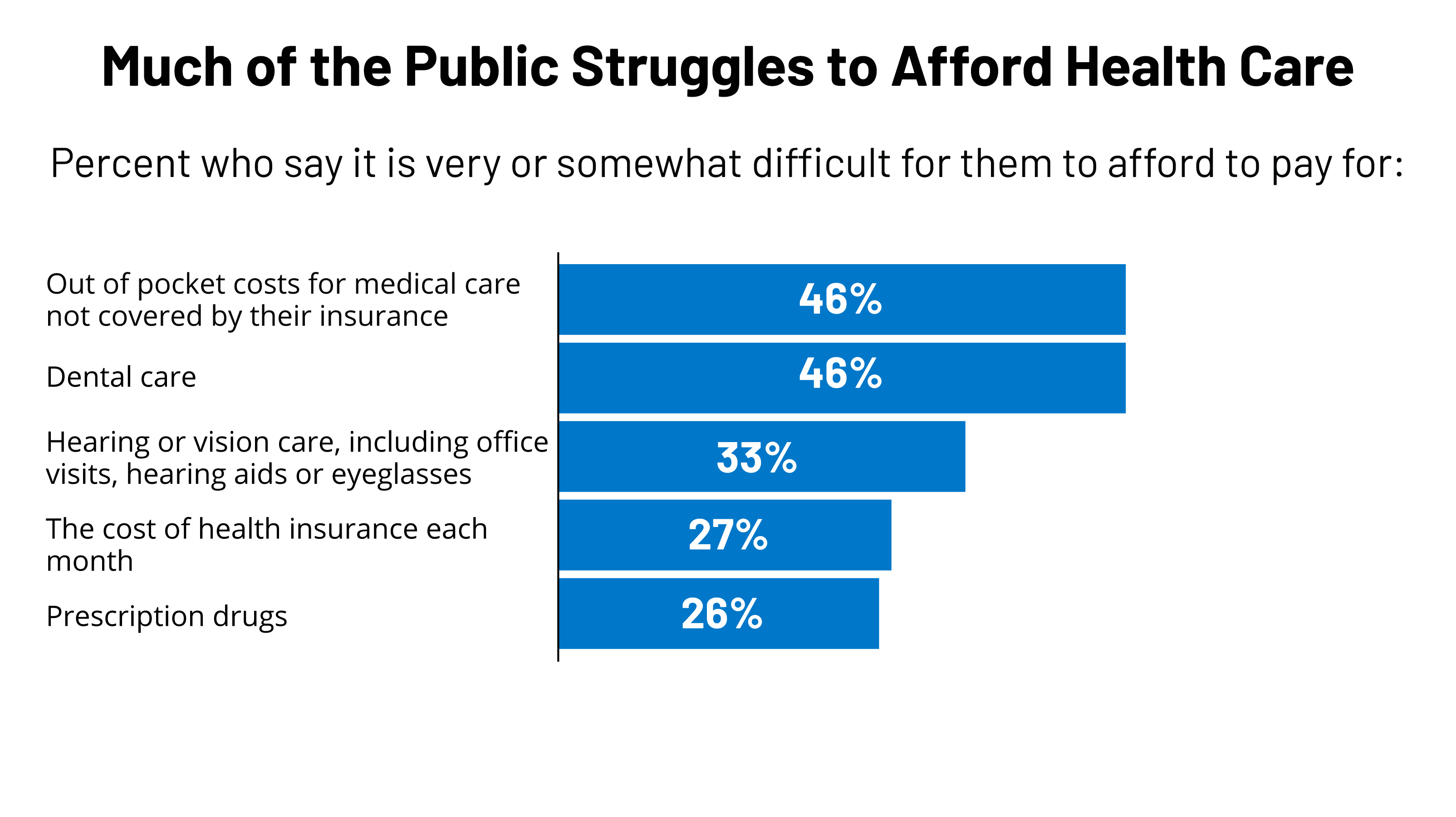

Americans Challenges With Health Care Costs Kff

65 Life Insurance vs.

. People that have coverage are punished for becoming sick and others are being punished for not being covered. Healthcare spending in the United States is 3 trillion a year straining the budgets of families businesses and taxpayers alike. They can either be prevented or would cost less to treat if caught in time.

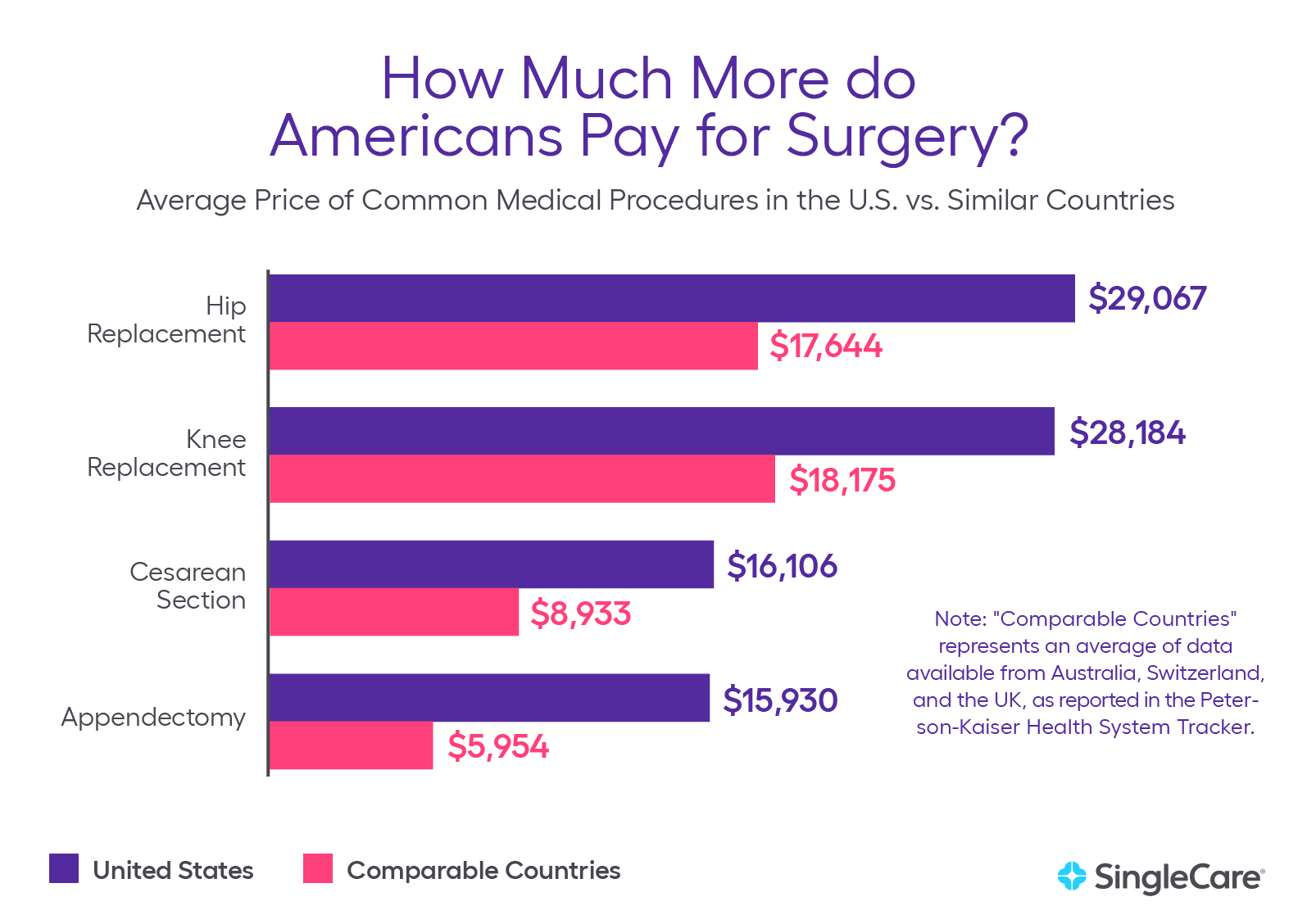

Coverage for dependents under age 18 will decrease. Why is health care so expensive. The United States healthcare system does not align with other systems.

60 rows The second cause of rising health care costs is an epidemic of preventable diseases. Spending on healthcare in the United States increased by. As we all know health care costs are on the rise in America.

In 1970 health spending totaled 741 billion but by 2019 that number had rocketed to 38 trillion. The plan worked but. If health care costs continue to rise insurance companies fear that.

According to data released by the Centers for Medicare and Medicaid Services CMS total health expenditures in the US. If health care costs continue to rise insurance companies fear that. Coverage for dependents under age 18 will decrease.

Chronic health conditions cause most of them. If health care cost continue to rise insurance companies fear that. Here are 4 reasons behind the soaring costs that insurance companies dont want you to know.

My car payment is cheaper than my monthly premium. Consumers will be driven to competitors who can offer lower prices. Health insurance quotes are estimates of costs of health insurance.

If medical costs continue to surge 2 to 3 higher than our nations ability to pay the healthcare system will soon reach a. Learn what makes healthcare so expensive why costs continue to rise and what we can do about it. My wife and I currently have 65 life insurance which we pay about 130 per month.

If health care costs continue to rise insurance companies fear that A. Coverage for dependents under age 18 will decrease. Theyll have to offer a greater variety of insurance policies.

This can help keep premium hikes in check. At the beginning of 2020 the outbreak of COVID-19 led health services spending to drop 86 in the second quarter of 2020 compared. As Congressional budget battles heat upor roll along depending on your time perspectivethe cost.

If health care costs continue to rise insurance companies fear that consumers will be driven to competitors who can offer lower prices. Have been on the rise. The four leading causes of death are heart disease cancer chronic obstructive pulmonary disorder and stroke.

If health care costs continue to rise insurance companies fear that A. Some can be for vision personal family business and many others. Government involvement will increase on both state and federal levels.

Government involvement will increase on both state and federal levels. If health care costs continue to rise insurance companies fear that a. Under health reform if your insurance company wants to raise premiums by 10 or more it must publicly justify the increase.

Theyll have to offer a greater variety of insurance policies. April 10 2013 1011 AM PDT. Best Life Insurance Companies.

According to the American Medical Association AMA healthcare costs are rising by about 45 a year. Has the highest prices for health care by far and its crushing consumers. Government involvement will increase on both state and federal levels.

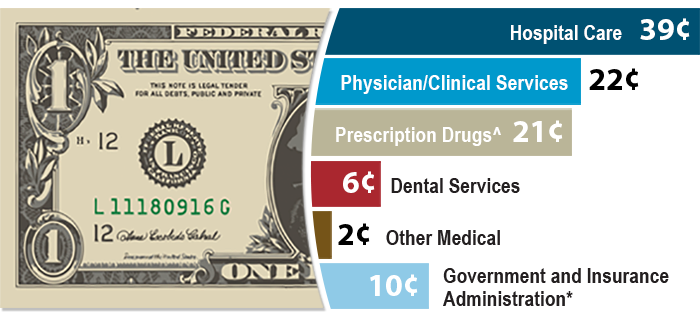

Consumers will be driven to competitors who can offer lower prices. The price of medical care is the single biggest factor behind US. They will have to raise rates on their policies possibly to the point where many policy holders can no.

In 2010 the state of Rhode Island decided to tackle high healthcare costs. Healthcare costs accounting for 90 of spending. The compensation package for job A includes 80 of the cost of a 300-per-month health insurance plan 90 of the cost of a 40-per-month life insurance plan a salary of 65000 per.

It did so by requiring insurers to meet affordability standards. Theyll have to offer a greater variety of insurance policies.

Health Care Costs In Retirement What To Expect How To Plan

Comments

Post a Comment